HOW TO: HELP WITH ESIGN

You will receive an email similar to this one. On the bottom of the email, please check on the image  as you can see below.

as you can see below.

Figure 1

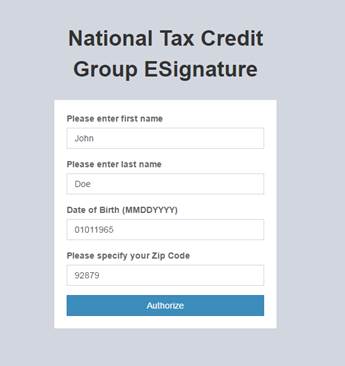

After opening the link, you will see Figure 1 on the left:

Step #1. Please note that you will enter your full name that was provided to your settlement officer.

Step #2. Please enter your Date of Birth without dashes or hyphens. Also as an 8 digit number. So if your date of birth is January 1, 1965, please enter 01011965

Step #3. Enter the zip code provided to your settlement officer as well.

Press Authorize button.

You will be presented with this page (Figure 2) after successful login:

Step 1: Please read through the document.

If you would like to view larger print, hold down the Control Key (CRTL) and press the ‘+’ (plus) key. Press minus (-) to reduce.

Step 2: Sign the document by starting on PAGE 2. When on PAGE 2, press the red ‘X Initial’

It will display this Figure 3:

Please HOLD YOUR LEFT MOUSE KEY DOWN and sign your initials. Please ensure there are initials in box before submitting.

If you are satisfied with your INITIALS, press the SAVE button. If you are not, then press the CLEAR button and start over. See Figure 4.

You will note that your initials are now inside the electronic document (Figure 5):

Please press the remaining red X’s on the left side navigation to get to the other signature and initial areas.

Page 3 or 4 is similar to this (Figure 6):

Please press the Signature and the Initial links to finish signing the document. Please ensure there is a signature in the box before submitting. See Figure 7.

If you have additional documents for signature, you will see a red X on the left side. Click on the left side navigation and it will take you to the page that needs to be signed.

Press the Red X in the center of the document and it will insert your initials or signature. The IRS 2848 – Power of Attorney, most times, will be found on the bottom on PAGE 9.

You will notice a popup on the bottom of your screen (Figure 8)when successful:

At this point, please download a copy for your records and afterwards, press the Submit button in green. For your information, a copy of the contract will be sent to the email on file as well. When you press the submit button, National Tax will be sent a copy and placed in your case file immediately.

**Please note: If you are not satisfied with your signature, press CLEAR SIGNATURE on the left and start over. If you do not sign the document within 24 hours, it will expire and a new one will have to be issued. Please contact your Settlement Officer for a new email with link. This is for your safety.